24

2023-08

SpaceRef: Hong Kong Aerospace Technology Group Opens New Satellite Factory to the World

Grand opening of HKATG's Hong Kong Factory

Hong Kong is nothing if not an economic powerhouse. The city of roughly 8 million people has a well-earned reputation as the international financial center of the Asia-Pacific region, and even though places like Shanghai and Singapore are giving it a run for its money, Hong Kong is still a dynamic and diverse economy with vast finance, real estate, trade, and tourism industries, among others. One industry that does not, however, come to mind when thinking of Hong Kong is space. With very limited (and expensive) land, and limited advanced manufacturing, Hong Kong's space sector is historically pretty tiny: The closest thing Hong Kong has had to a space sector is the few satellite operators with HQs in the city.

Despite these disadvantages, last month saw the inauguration of one of Asia's largest satellite factories in Tseung Kwan O Industrial Park, located just about a 20-minute subway ride from the heart of Hong Kong. The factory was primarily financed by the Hong Kong Aerospace Technology Group (HKATG), built with major support from the state-owned Shanghai Academy of Spaceflight Technology (SAST), and to be utilized by new HKATG subsidiary ASPACE. Having overcome the major challenge of building a satellite factory in Hong Kong, HKATG and ASPACE will now need to answer a more challenging question: Having built it, will demand come?

Who is HKATG?

HKATG was founded in 2019, with a founding team coming primarily from the finance and government sectors in Hong Kong. With very limited space industry experience, HKATG's early successes primarily consisted of acquiring subsidized land in a Hong Kong industrial park, and executing an audaciously early-stage IPO on the Hong Kong stock exchange via SPAC. The company's valuation today remains a not unimpressive HK$2.5 billion (US $320 million).

HKATG's business plan is a little bit vague, and somewhat all over the place. For starters, the company is operating the Golden Bauhinia constellation of remote sensing satellites, of which they have launched 10 out of a planned 165. Despite five of these Golden Bauhinia satellites launching as early as 2021 (the remainder launching in 2022 and 2023), HKATG's 2022 annual report recorded zero revenues related to remote sensing.

Separately, a recent profit warning highlighted issues with rapid depreciation of the company's satellites, and HKATG's website lists no substantive information about remote sensing beyond industry applications, which include the dubious "open trash," "road maintenance," and "road collapse," among others. The Golden Bauhinia constellation is noted to have "complete coverage of 11 city clusters in the Guangdong-Hong Kong-Macao Greater Bay Area" (GBA), but this is likewise a bit of a head-scratcher: Hong Kong is tiny, and the entire GBA is very densely populated and well-connected; satellite remote sensing doesn't make much sense here.

In short, having launched 10 Golden Bauhinia remote sensing satellites thus far, HKATG appears to have no substantial remote sensing business, and some of the applications the company advertises are not remote sensing verticals at all, or otherwise do not make a lot of sense.

Which brings us to HKATG's next business line — satellite manufacturing — for which there is at least a more plausible narrative. HKATG's satellite manufacturing value proposition appears to stem from a combination of the massive space industrial base of China and the relative geopolitical neutrality of Hong Kong. Throw in a sizeable dash of free land or money from the Hong Kong government, and voilà, you have a business.

To now, HKATG has been trying to sell batches of LEO communications satellites, primarily to developing countries. The company signed an MoU with the Government of Djibouti to much fanfare in January 2023, with the MoU expiring to dramatically less fanfare in April 2023. Other agreements include a September 2022 MoU with Italian space logistics company D-Orbit for "cooperation in manufacturing and satellite technology," with the MoU apparently calling for HKATG to provide "satellite and payload launching services to D-Orbit, tentatively manufacturing 20 satellites per year." D-Orbit, for its part, does not mention Hong Kong or HKATG anywhere on its website.

Moving forward, HKATG's satellite manufacturing operation may ultimately prove more sensible than the Golden Bauhinia constellation, particularly given:

1) The number of EO constellations already present in the market, and

2) The potential for some actual competitive advantages of manufacturing satellites for export in Hong Kong using Chinese components.

This could be especially true if the company starts to pick up momentum with its shiny new factory.

What's the story with the new factory?

On July 25 this year, HKATG held a grand opening of its satellite factory in Hong Kong. And what a grand opening it was. The company invited many dozens of foreign guests, offering return airfare to Hong Kong and putting them up in the Four Seasons Hotel in Central Hong Kong (approximately US $500 per night). Attendees came from the UAE Space Agency, Mexican Space Agency, Bahrain National Space Science Agency, the National Space Research and Development Agency of Nigeria, and others. As an indication of how badly the company wanted people to come, no less than 10 recent articles on the company's "News Center" confirmed that the guest list included attendees from space agencies around the world.

Most of the equipment in the company's factory came from SAST at a likely cost of at least several tens of millions of dollars. During the grand opening, HKATG and ASPACE announced plans to produce over 200 commercial satellites per year, ranging from 10 kg to 1 ton. The factory covers around 200,000 square feet and has more than 200 pieces of precision equipment, making it "one of the world's largest smart satellite manufacturing facilities," according to HKATG. According to HKATG CEO Sun Fengquan, the factory will "decrease the costs of manufacturing satellites and providing satellite data services by more than 20 percent."

Conclusions: what to make of HKATG?

Today, HKATG remains more of a financing vehicle than a true space company, but this is apparently starting to change. The inauguration of its factory in Hong Kong is a major first step, though obvious challenges remain. The company seems intent on capturing part of mainland China's demand for satellites, yet there are a host of other satellite manufacturers that are more well-established. And for international demand, there remains the difficulty in working with Chinese suppliers. Aside from that, there remains the minor detail that HKATG lacks significant space heritage and has yet to build any satellites in Hong Kong.

With that said, the company does seem to have picked up some traction following the factory's grand opening, including a recently-announced MoU with the Mexican Space Agency and an apparent visit to the Saudi Space Agency earlier this month. As noted above, the value proposition of leveraging the Chinese space industrial base and relative political neutrality of Hong Kong could be a real one. Some of the disadvantages inherent to Hong Kong — high real estate prices and expensive labor — are less of an issue due to subsidized land and the high-value nature of satellite manufacturing.

Overall, it's still too early to tell whether HKATG will be able to make Hong Kong a satellite manufacturing hub. So far, the company has done an admirable job of raising money, recruiting respectable experts to its Board of Advisors, and attracting attention by publishing press releases like mad. In the long run, if the space sector experiences the type of growth that the more optimistic forecasters envision, it's not so hard to imagine HKATG being able to capture a piece of the market. But in the meantime, to get from here to there requires quite a few "ifs" to work out in HKATG's favor.

-

29

2025-05

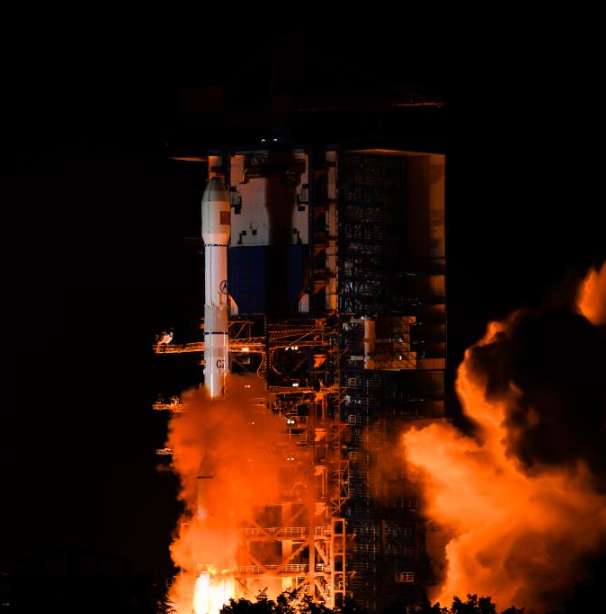

Tianwen-2 Mission Launched Successfully

At 1:31 AM today, China successfully launched the Tianwen-2 planetary exploration probe from the Xichang Satellite Launch Center using the Long March-3B Y110 carrier rocket.

-

13

2025-05

Communication Technology Experiment Satellite No. 19 Successfully Launched

At 2:09 on May 13, China successfully launched the Communication Technology Experiment Satellite No. 19 from the Xichang Satellite Launch Center using a Long March 3B carrier rocket. The satellite smoothly entered its predetermined orbit, and the launch mission was a complete success.

-

12

2025-05

Remote Sensing Satellite No. 40, Group 02, Successfully Launched

On May 11 at 21:27, China successfully launched the Remote Sensing Satellite No. 40, Group 02, from the Taiyuan Satellite Launch Center using a Long March 6A carrier rocket. The satellite entered its predetermined orbit smoothly, and the launch mission was a complete success.